How to set Stop Loss & Take Profit in MetaTrader 4

The MetaTrader 4 platform provides many features that help traders execute trades with reduced financial risk. The first and most important thing you can do is to carefully monitor your trades and margins. Attaching Stop Loss and Take Profit orders on trades is an option that most traders use to manage their positions without the need to constantly monitor them. Another way to manage trading risk is by placing Limit and Stop orders. In the last case scenario, the margin call and liquidation level predetermined by the trading company will be activated.

This MetaTrader 4 tutorial will teach you:

- What is Stop Loss and Take Profit;

- How to set up Stop Loss and Take Profit in MT4;

- To calculate a Stop level for your order;

- To modify Stop Loss and Take Profit after placing the order;

What is Stop Loss and Take Profit?

This is a tool often used by traders for the management of trading risks. Using a S/L is one of the methods for preventing margin calls and liquidation of open positions. To be effective the S/L on a trade should be placed higher than the margin call level.

The advantage of utilizing S/L and T/P is that traders don’t have to worry about executing trades manually, trading emotionally or being stuck at your computer waiting for a certain price. Traders need to understand the characteristics of each market they’re trading. Certain markets gap from day to day. Shares are a prime example of this, it’s not uncommon for shares to gap over 1% from session to session. Traders need to factor this into their S/L and T/P as if a market gaps over or under their price the S/L or T/P can’t be filled at the target price, it will be filled at the next available price. This can lead to larger losses if the price opens below the traders S/L price.

S/L and T/P orders can be placed at levels that are based on market analysis, trend patterns and various indicators.

Step 1 – How to set up Stop Loss and Take Profit in MT4

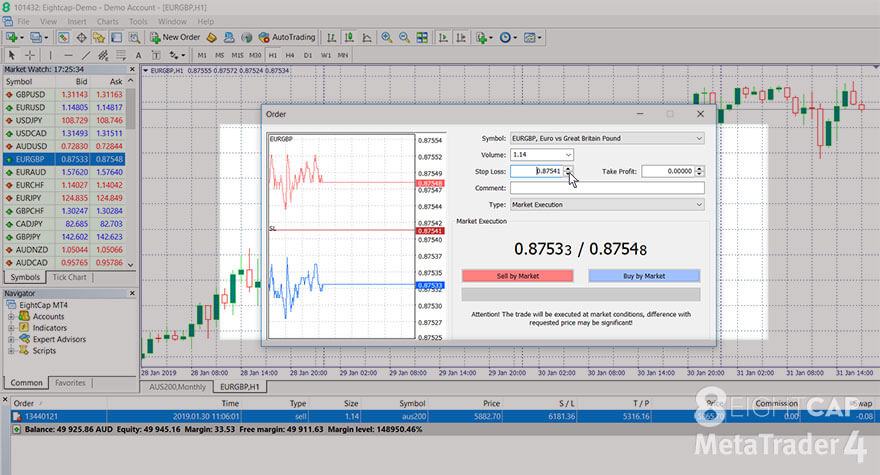

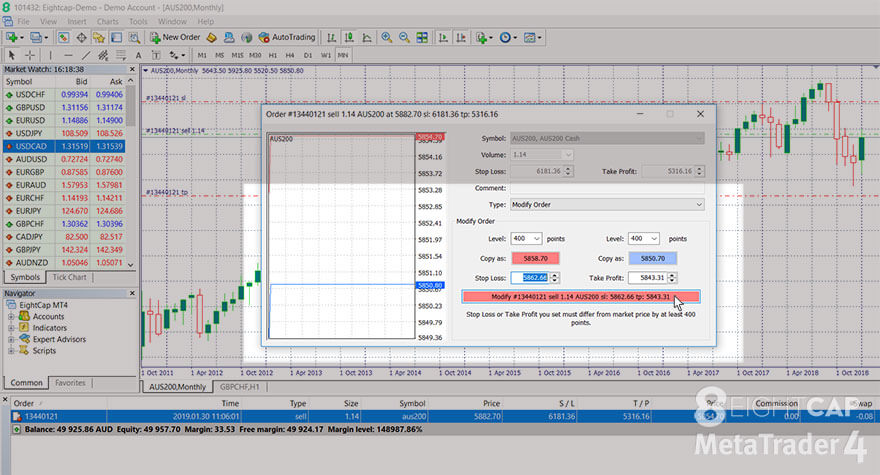

Modify trade in the Order window

In the Order window, you can modify your order starting from the order volume (lot size) and setting up Stop Loss or Take Profit. Once you click on the arrows in the S/L and T/P fields, the current price will pop up and you can adjust it from there.

If you want to know more about placing and closing trades, please read EightCap’s “How to open and close trades in MetaTrader 4?” guide.

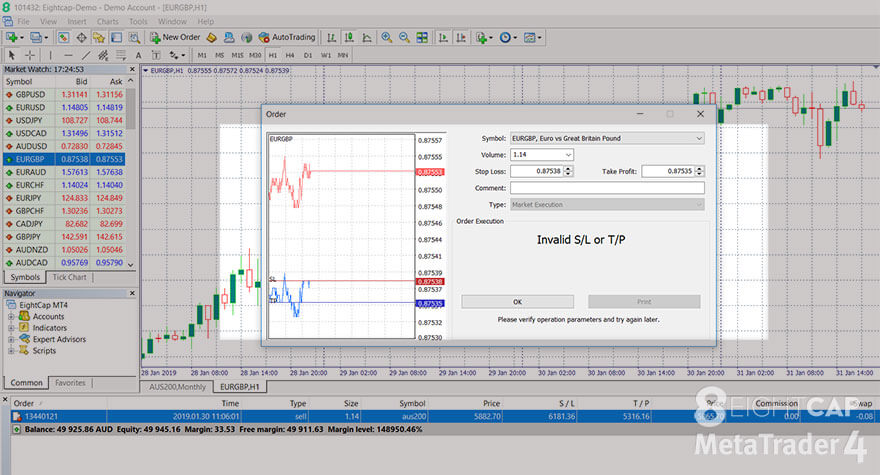

If the S/L or T/P you have set is too close to the current price, the message “Invalid S/L or T/P” will be shown.

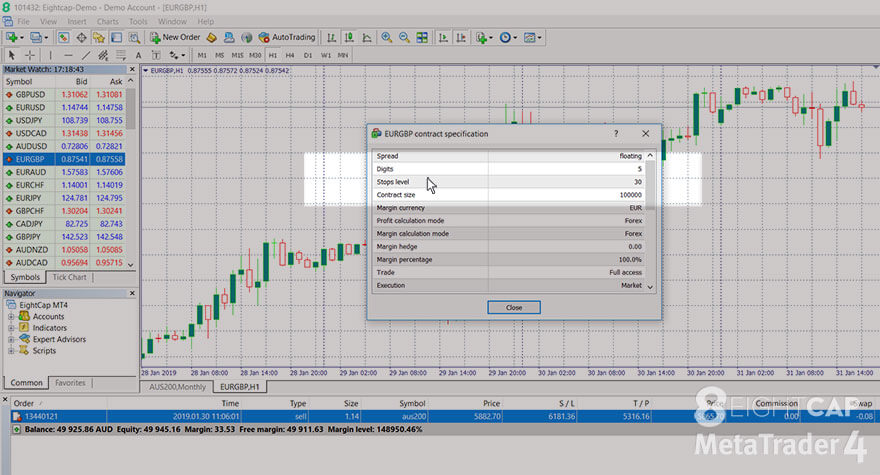

How to calculate the Stops level for the instrument

To start calculating at what level your S/L and T/P should be placed, go to the instrument you want to trade in the Market Watch. Then select ‘’Specification’’ from the context (right-click) menu.

In the new window that opens you can see the ”Stops level” for the instrument. This number shows the minimal difference you need to have between the current price and the S/L or T/P levels you want to set. This difference is measured in pips. This means that if the ”Stops level” for the instrument is 30 and the current price level is for example 1.32136 and you decide to buy, you will have to set up an S/L of at least 1.32106 and a T/P of at least 1.32166. Once you submit the order, a message confirming the successful placement of the trade will be displayed.

If you want to learn more about pips and calculating them, please read EightCap’s “What is a pip?” article.

Step 2 – How to modify Stop Loss and Take Profit in MT4

You can add and modify S/L and T/P after you have already placed an order. From the Terminal window, in the Trade tab, you can see all of your open trades. With a right-click on the trade, you can choose to close, modify or to add a trailing stop. Select “Modify or Delete Order” from the menu.

The modify window will open, with a “Modify Order” section where you can see the ‘’Stops level” of the instrument and ”Copy as” buttons (in blue and red). They copy the current price into the S/L and T/P fields, allowing you to modify the levels more easily. If the numbers you enter are invalid the big ”Modify” button at the bottom will turn gray, signaling you to make corrections. Click the button to submit the changes when you are ready. The new S/L and T/P levels will appear in the Terminal and on the chart.

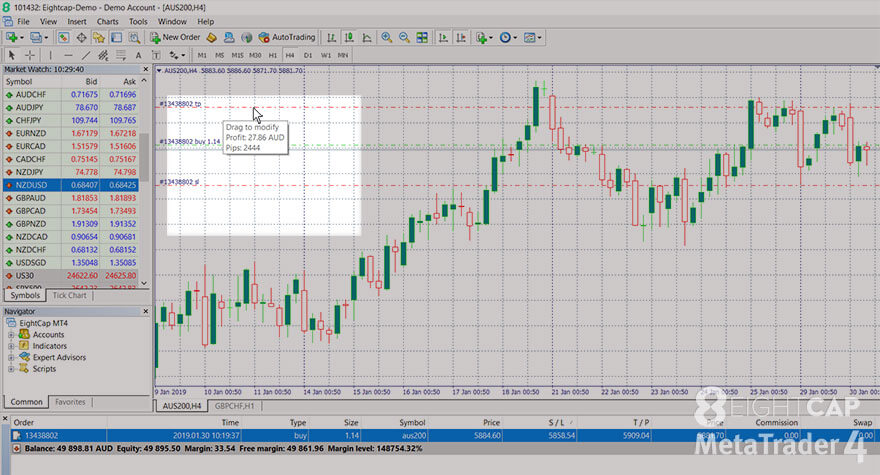

To modify the Stop Loss and Take Profit you can also use S/L and T/P lines on the chart. Simply drag them with the mouse. If you use charts for your trading this is the easiest method to use.