How to find volume, contract size, swap rates and more specifications in MetaTrader 4?

Eightcap enables you to trade Forex, CFDs, indices and more with the top-of-the-line MetaTrader 4 platform.

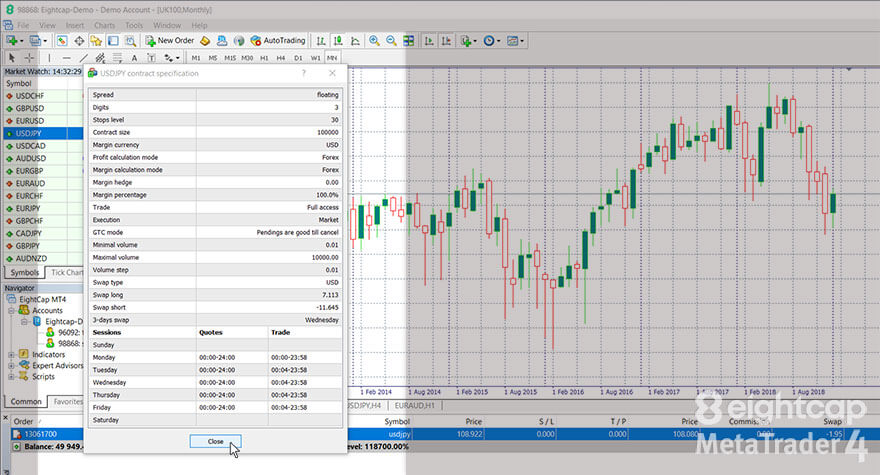

The Specification window accessible from the Market Watch in MetaTrader 4 allows the trader to quickly check the contract specifications of each trading instrument. This article will help you to navigate through it.

This MetaTrader 4 tutorial will teach you how to:

- Find the Specification window;

- Learn how to interpret symbol data (contract size, swap rates, margins etc.);

- Check trading sessions.

Step 1 – Open the Specification window from the Market Watch

To view the specifications of an instrument, right-click on the corresponding symbol in the Market Watch window. From the context menu of that symbol, select “Specification” and a pop-up will appear with all you need to know about that particular market.

You can expand the window or scroll to see all the data.

Step 2 – Learn how to use the symbol data

The Specification window for each symbol contains the following parameters:

Spread

It shows the difference between the Buy and Sell prices of the selected symbol in points. If the spread for that instrument is variable, it will display “floating” instead of a value. In that case, you can see what the current number is if you look up the difference in prices at that moment. Learn more about spreads in this article.

Digits

It’s a parameter that tells you how many digits there are after the decimal point in the price of an asset.

Stops level

This number shows the minimal difference you need to have between the current price and the Stop Loss or Take Profit levels you want to set. This difference is measured in pips. If you place an order with a smaller difference, the server will return an “Invalid Stops” message and won’t accept it. To learn more about Stops, please read our “How to set Stop Loss & Take Profit in MetaTrader 4” article.

Contract size

This is the number of base units that comprise 1 lot of the asset. For example, 1 standard lot for Forex pairs consists of 100,000 base units.

Margin currency

The parameter displays in which currency the margins of your account are calculated.

Profit calculation mode and Margin calculation mode

These two figures inform the trader on the available method for profit and margin calculation (based on the type of asset).

Margin hedge

It describes the margin size applied for hedged positions per lot.

Margin percentage

Margin % specifies what part of the base margin is calculated depending on the asset type.

Trade

Indicates if there are any limitations in regards to trading the selected instrument: “Full access” means that you can freely close and open positions and “Disabled” means that you cannot trade this asset.

Execution

The parameter simply displays the type of execution: Instant, Request or Market execution.

GTC (Good ‘Til Canceled) mode

Shows the expiration conditions of orders. Most symbols will be in the “Pendings are good till cancel” mode: unlike day trades, these positions remains active until the order is filled or canceled by the investor. “Good till today including SL/TP” and “Good till today excluding SL/TP” are applied to day orders, which are valid for only 1 trading day. At the end of the day, the orders are deleted (and their SL/TP in the first case).

Minimal and Maximal volume

The parameters show the available volume range of the trading instrument.

Volume step

It shows the smallest amount, with which the trading volume can be modified.

Swap type

The symbol displays the currency, in which swap rates are charged.

Swap long

It gives you the swap rate charged for a long / Buy position.

Swap short

Gives you the swap rate charged for a short / Sell position.

3-days swap

Indicates on which day of the week the triple swap is applied.

Trading sessions

At the bottom of the Specifications window, you can find the quoting and trading sessions of the symbol for every day of the week. Look those up whenever you are not sure when a market opens and closes.