Mastering TradingView’s All Chart Patterns Indicator

TradingView’s All Chart Patterns indicator stands as a versatile tool that provides traders with a comprehensive view of various chart formations. These patterns serve as visual representations of historical price movements and can be powerful indicators of potential trend reversals or continuations. This guide will delve into the intricacies of the indicator, highlighting its features, the best markets to apply it to, and the optimal trading approaches for leveraging its insights.

Understanding the “All Chart Patterns” Indicator on TradingView

Key Features

1. Comprehensive Pattern Recognition: The All Chart Patterns indicator boasts an extensive library of recognized patterns. This includes reversal patterns like Head and Shoulders, Double Tops, and Triple Bottoms, as well as continuation patterns like Flags, Triangles, and Pennants.

2. Customizable Alerts: Traders can set up alerts for specific patterns, allowing them to receive timely notifications when a pattern is identified. This is invaluable for traders who cannot continuously monitor the markets.

3. Timeframe Flexibility: The indicator adapts seamlessly to various timeframes, catering to traders with different trading horizons. Whether you’re a day trader or a swing trader, this flexibility ensures applicability across different strategies.

4. Clear User Interface: TradingView’s intuitive platform design extends to the All Chart Patterns indicator. Patterns are displayed prominently on the chart, accompanied by clear labels for easy identification.

Which are the patterns this indicator can identify and display

The “All Chart Patterns” indicator on TradingView is designed to identify and display a wide range of chart patterns. While the exact list of patterns may evolve with updates to the platform, as of September 2023 here is a list of chart patterns that the indicator typically includes:

Reversal Patterns:

- Head and Shoulders

- Inverse Head and Shoulders

- Double Top

- Double Bottom

- Triple Top

- Triple Bottom

- Rounding Bottom (Cup and Handle)

- Rounding Top (Saucer)

Continuation Patterns:

- Ascending Triangle

- Descending Triangle

- Symmetrical Triangle

- Bull Flag

- Bear Flag

- Pennant (Bullish and Bearish)

- Rectangle (Bullish and Bearish)

- Wedge (Rising and Falling)

- Channel (Upward and Downward)

Best Markets for the All Chart Patterns Indicator

This indicator is suitable and can be quite efficient on any market or asset types available on your Eightcap Trading account on the TradingView Platform. Let us add a bit of detail per asset tupe below:

Forex Market

The Forex market is highly liquid and known for its well-defined trends. The All Chart Patterns indicator can be particularly effective in identifying potential reversals or continuations in major currency pairs like EUR/USD, GBP/USD, and USD/JPY. When utilizing the All Chart Patterns indicator in the Forex market, consider the following approaches:

- Trend Following: Identify patterns that align with the prevailing trend. For instance, in an uptrend, focus on continuation patterns like Flags or Pennants.

- Counter-Trend Trading: Look for reversal patterns in markets exhibiting strong trends. For example, if a major currency pair shows signs of exhaustion, a reversal pattern like Head and Shoulders may signal a potential trend reversal.

Stock CFDs Markets

Equity markets, especially those with high trading volumes, provide fertile ground for pattern recognition. Blue-chip stocks like Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT) are often closely followed by traders, making them possible candidates for applying the All Chart Patterns indicator. When utilizing the All Chart Patterns indicator in the stock market, consider the following approaches:

- Earnings Season Strategies: During earnings seasons, patterns like Flags and Pennants can be particularly relevant as they may signal potential breakouts or reversals based on company performance.

- Sector Rotation Strategies: Monitor sectors that are showing relative strength or weakness. The All Chart Patterns indicator can help identify patterns within specific sectors, guiding allocation decisions.

- Position Trading: For traders, the indicator can serve as a tool to identify potential entry points in fundamentally strong companies for long-term holdings. The analysis is often done based on 12H, Daily, Weekly and Monthly Charts

- Event-Driven Trading: Pay attention to significant events like product launches, mergers and acquisitions, or regulatory changes. These can lead to patterns like Gaps or Breakouts

Cryptocurrency Market

The cryptocurrency market is known for its volatility, presenting ample opportunities for traders. Bitcoin (BTC), Ethereum (ETH), and other major cryptocurrencies are popular choices for utilizing the indicator to identify significant price movements. When utilizing the All Chart Patterns indicator in the cryptocurrency market, consider the following approaches:

- Volatility Management: Given the high volatility in the crypto market, be prepared for significant price swings. Set wider stop-loss levels to account for this volatility.

- News and Events: Pay close attention to news and events in the crypto space, as they can have a substantial impact on prices. Regulatory changes, partnerships, and technological developments can lead to significant price movements.

- Investing Long-Term vs. Short-Term Trading: Decide whether you’re looking for short-term trading opportunities such as the vast majority of our traders or long-term investments on the crypto exchanges. The indicator can be applied to both approaches, but your strategy should align with your goals and risk tolerance.

- Security Considerations: Ensure that you’re using a secure and reputable cryptocurrency broker, such as Eightcap for example, for your trading.

Precious metals and Oil markets

Commodities, including precious metals like gold and silver, as well as energy resources like oil, present favorable conditions for pattern recognition. The All Chart Patterns indicator can be employed to identify potential shifts in supply and demand dynamics. When utilizing the All Chart Patterns indicator in these markets, consider the following approaches:

- Supply and Demand Analysis: Pay attention to factors affecting the supply and demand of the specific commodity. Production levels, geopolitical events, and economic indicators can significantly impact prices.

- Macro-Economic Factors and USD Correlation: Consider economic indicators like GDP, inflation rates, and interest rates, along with the value of the US dollar, as they can influence commodity prices

- Long-Term Investing vs. Short-Term Trading: Decide whether you’re looking for short-term trading opportunities on Eightcap’s Trading View accounts or long-term investments on the futures markets or physical holdings. The indicator can be applied to both approaches, but your strategy should align with your goals and risk tolerance.

Stock Indices

Indexes such as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are pivotal indicators of the overall market sentiment. The All Chart Patterns indicator can assist traders in identifying potential turning points in these indices, providing insights into broader market trends.

When utilizing the All Chart Patterns indicator in the indices market, consider the following approaches:

- Trend Analysis: Assess the prevailing trend in the index before using the indicator. Patterns that align with the established trend may have a higher probability of success.

- Earnings Seasons Strategies: During earnings seasons, patterns like Flags and Pennants can be particularly relevant as they may signal potential breakouts or reversals based on company performance.

- Market Sentiment and Economic Events: Keep an eye on economic indicators, central bank policies, and geopolitical events. These can provide context and additional confirmation for your trading decisions.

- Diversification: Consider diversifying your portfolio across different indices to spread risk and gain exposure to various sectors of the economy.

Tailoring Your Trading Approach

Confirmation is Key

While the All Chart Patterns indicator excels at pattern recognition, it’s essential to exercise patience and wait for confirmation before executing a trade. Additional technical analysis or the use of complementary indicators can help validate the signals provided.

Combine with Other Tools

To enhance the reliability of your trading decisions, consider integrating the All Chart Patterns indicator with other technical indicators like Moving Averages, Relative Strength Index (RSI), or Moving Average Convergence Divergence (MACD).

Implement Robust Risk Management

Prudent risk management practices are generally encouraged in trading. Set stop-loss orders and determine appropriate position sizes to help safeguard your capital and minimize potential losses.

Back-testing for Validation

Before deploying any trading strategy, conduct thorough back-testing using historical data. This may help validate the effectiveness of your approach under various market conditions.

Risk Management for Different Asset Types

General Principles

Regardless of the asset type you’re trading, effective risk management is essential to protect your capital and help improve the chances of overall success. Here are some universal risk management principles:

1. Diversification: Spread your exposure across different assets or asset classes to reduce the impact of a single loss.

2. Position Sizing: Determine the size of each trade based on your risk tolerance and the specific characteristics of the asset. Avoid risking a significant portion of your capital on a single trade.

3. Stop-Loss Orders: Set a clear exit plan for your trades. This prevents potentially significant losses and should assist you in sticking to your predefined risk limits.

4. Risk-Reward Ratio: Evaluate the potential reward against the amount at risk before entering a trade. A favorable risk-reward ratio can increase your chances of overall success.

5. Stay Informed: Stay updated on market news, economic events, and geopolitical developments that may impact the assets you’re trading. Our Clients are performing such detailed analysis using our state-of-the-art Economic Calendar and also, the detailed instruments pages on our website.

To utilize the “All Chart Patterns” indicator, follow these steps:

1. Accessing the Indicator: Open the TradingView platform and once logged in to your Eightcap Trading Account, navigate to the chart of the asset you’re interested in. On the top of the platform, you’ll find a toolbar where you need to click on “Indicators” and then select Technicals from the left-hand side menu, select Patterns on the top. You can also type “All Chart Patterns” in the search bar.

2. Adding the Indicator: Click on “All Chart Patterns” when it appears in the search results. This will add the indicator to your chart.

Customizing the Indicator:

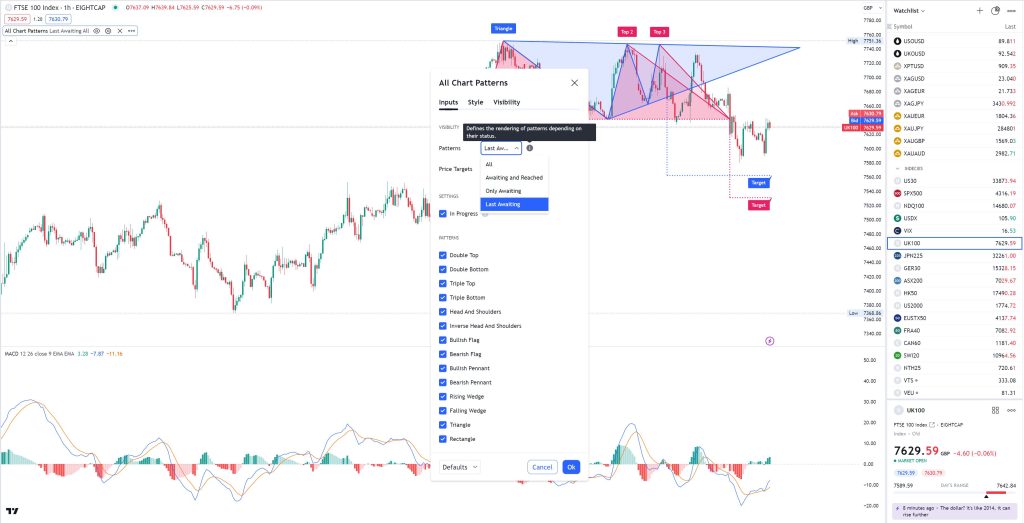

1. Pattern Selection: You can customize the indicator by selecting specific patterns you’re interested in. Click on the settings icon next to the indicator on your chart to open the customization menu and under the Inputs tab, you will find all available selections. You can also choose patterns to be rendered by Status or Price, where the choices are between Awaiting or already Reached.

Keep in mind, that if a single pattern indicator is applied, more customization and features will be available. For example, when the All Chart Patterns indicator is applied no Alerts could be added and no visual customization will be available. Also new Elliot Wave will not be available.

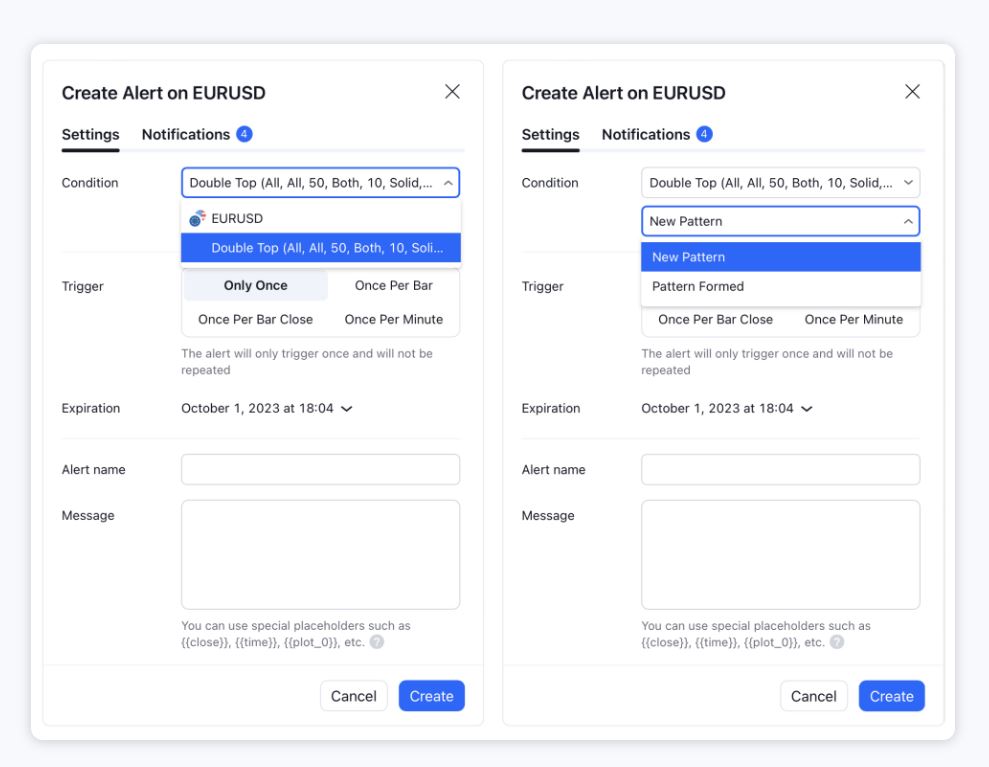

2. Setting Alerts: You can set up alerts for specific patterns to receive notifications when they are identified. But this can only be done when a specific chart pattern indicator is applied to the chart as the All Chart Patterns indicator does not allow alerts and new Elliot Wave. To set an alert, make sure that a chart pattern is added to the chart, then go to the Alerts menu, select the pattern you need, and choose a necessary condition.

3. Visibility Settings: To make working with patterns more convenient, visibility settings are added – they allow you to control which patterns and targets should be displayed on the chart. Now, for example, you can display only the last pattern that hasn’t worked out yet or all similar patterns. Customize the appearance of the patterns on your chart to suit your preferences. Again, not applicable when the All Chart Pattern indicator is applied to the chart.

TradingView’s “All Chart Patterns” indicator stands as a powerful ally for traders seeking to enhance their technical analysis across various asset classes. From forex markets to precious metals, energy resources, cryptocurrencies, stocks, and indices, this versatile tool offers a comprehensive view of potential trend reversals and continuations.

By adhering to key principles such as diversification, disciplined position sizing, setting stop-loss levels, and assessing risk-reward ratios, traders can aim to safeguard their capital and potentially increase their chances of overall success.. Additionally, staying informed about global economic events, geopolitical developments, and market news is essential for making informed trading decisions.

Ultimately, the “All Chart Patterns” indicator, when combined with prudent risk management and a holistic trading strategy, can be a potent tool in a trader’s toolkit. By leveraging its pattern recognition capabilities, traders can potentially increase their chances of success in the complex and dynamic world of financial markets.

* The information provided here has been prepared by Eightcap’s team of analysts. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap.

In addition to the disclaimer on our website, the material on this page does not contain a record of our trading prices, or represent an offer or solicitation for a transaction in any financial instrument. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Please note that past performance is not a guarantee or prediction of future performance. This communication must not be reproduced or further distributed without prior permission.