What is Scalping in Trading?

What is Scalping?

The definition of scalping in financial trading is very similar to that of scalpers who buy and resell concert or sporting tickets for a small or quick profit. But instead of standing outside busy venues yelling at passers-by, a forex scalper can do it from the comfort of their computer. Scalping in financial trading, whether it’s forex or CFDs, refers to a style of trading where investors enter a position for a very short time frame. Traders may enter or open a position for as little as a few minutes before liquidating once the price rises by a few pips.

Some scalpers will open the position for less than a minute, while others keep the position open for up to 5 minutes or more. Because of this, scalpers focus on the more liquid currency pairs or markets. The aim of scalping is to make lots of small profits on ‘safer’ trades, as opposed to making a large profit on one risky trade. Some traders who use scalping as a strategy could place dozens or even hundreds of small trades each day. Because traders are required to pay a spread, which is the difference between buying and selling, scalping profits are minimal.

Despite this, scalping is a popular trading method used by many investors across different markets. Scalping is permissible if traders are speculating on price changes and not manipulating the market.

Why use Scalping as a strategy?

The strategy is aimed at reducing risk and reducing potential losses. But at the same time, any profits made from a trade will be significantly smaller. Scalpers rely on small and frequent gains, as opposed to buy/sell and holding strategies used within swing trading. In order to make a noticeable profit, traders must be patient, allowing small positions to accumulate over time. Scalping requires more attention than long-term trading due to the frequency and faster time frames involved.

An individual’s accuracy and speed when entering and exiting the market also contribute to profitability. But scalping isn’t just a manual method of trade, it can be automated too. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) allows traders to enter an automatic stop loss or take profit in the software. Scalpers primarily rely on charts and trends, or rather technical analysis before opening or closing a position. This includes analysing moving averages and the relative strength index (RSI) of a currency pair or

Benefits of Scalping

Like any trading strategy, scalping has its benefits:

Easy strategy

Scalping is a strategy that can be easily understood by new and experienced traders. As long as the trader is disciplined and nimble with executing trades, scalping requires less knowledge of the overall market.

Lower risk

Because scalping is executed over very short time-frames, exposure is limited, and therefore the risk of facing an adverse event is lower. Scalpers never leave trades open overnight.

More frequent

Smaller moves in the market are both easier to obtain and more frequent than larger moves, even during quiet periods.

Leverage

Scalpers can use their margin/deposit to leverage trades and open larger positions in a bid to make a higher profit.

Risks of Scalping

Scalping isn’t without its risks:

Demanding

Scalpers are executing trades within minutes, if not seconds of each other. Because of this, scalping requires a high level of concentration to enter and exit a trade. A lapse in concentration or attention could cost a scalper profit, therefore scalping can be very demanding.

High fees

Due to the sheer volume of trades executed throughout the day (sometimes hundreds), commissions and/or fees are also high (e.g. having to pay the spread between a buy and a sell trade).

No guarantee

Just because the positions are short-lived doesn’t guarantee a profit. A currency pair or CFD can quickly change and move in the opposite direction.

Types of Scalping strategies

There are several types of scalping strategies used by day traders with some strategies more popular than others.

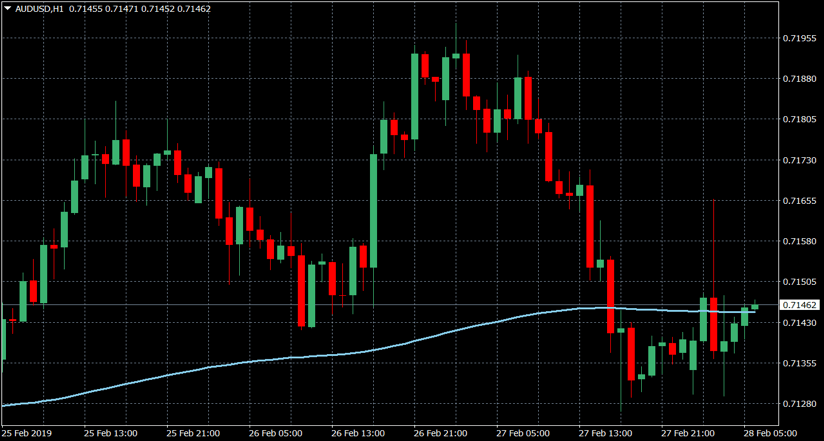

Moving average strategy

As mentioned earlier, scalpers primarily rely on technical indicators to open and close a position. One technical indicator that is used by scalpers is moving averages, whether it’s analysing the Simple Moving Average (SMA) or the Exponential Moving Average (EMA). Scalpers use moving averages to identify a trend and opportunity in the market to open positions. Below is an example of a 200-day EMA on a candlestick chart, indicated by the blue line.

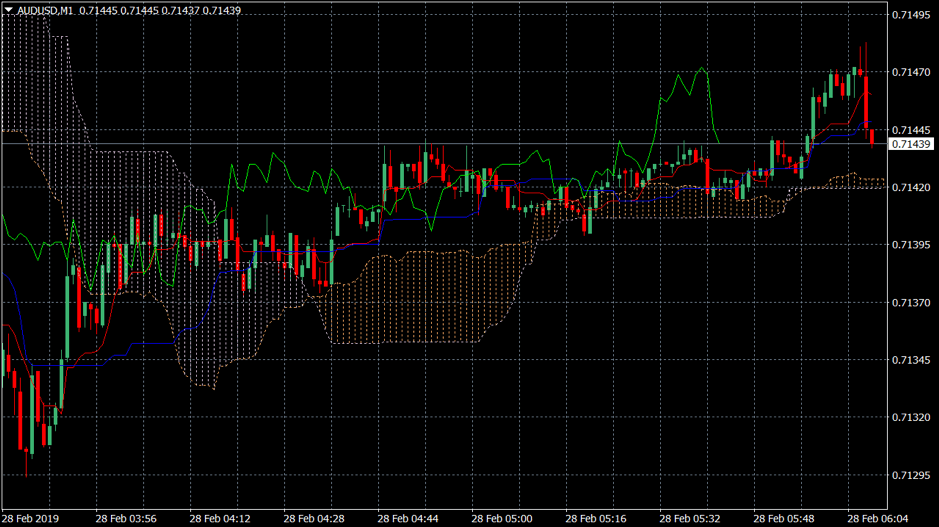

Ichimoku

The Ichimoku Kinko Hyo indicator, also known as an equilibrium chart, can be used as a short-term indicator (usually 1-minute charts) to gauge future areas of support and resistance and future price momentum. All three indicators are represented as three separate lines as illustrated below. The ‘standard line’ in blue calculates the average of the highest high and the lowest low for the past 26 sessions. The ‘turning line’ is highlighted in red and is the average of the highest high and lowest low for the past 9 sessions. Finally, the ‘lagging line’ in green is the closing price plotted 26 sessions behind.

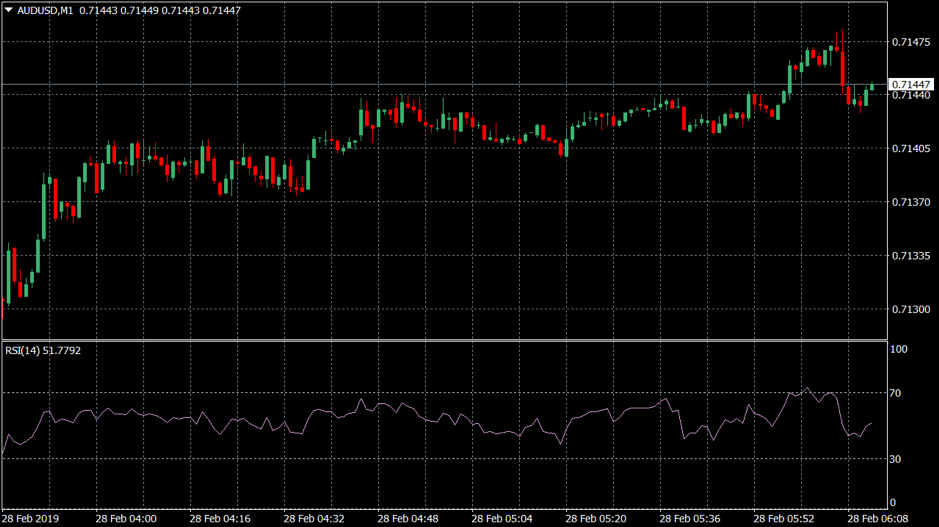

Relative Strength/Weakness Exit Strategy

The relative strength index (RSI) measures the size of a recent price change to assess overbought or oversold conditions in the value of a financial asset. On the flip side, the RSI also evaluates undervalued financial assets or derivatives. When the RSI reading is over 70, the forex pair is overbought and when the value is under 30, the forex pair is oversold. The RSI is indicated by the purple line below the candlesticks.

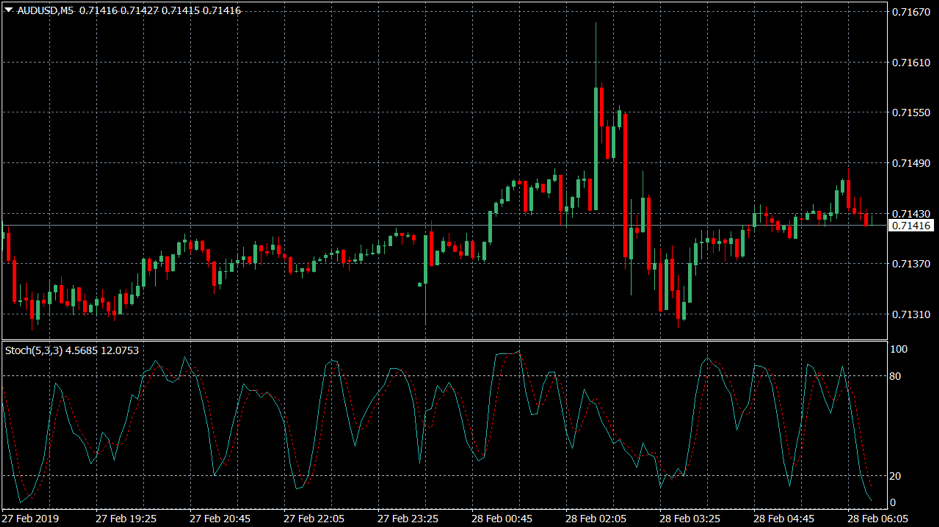

Stochastic

The stochastic indicator is a momentum oscillator used to pinpoint potential trend reversals. It uses a reading of 1-100 to indicate when to buy or sell the financial asset. If the reading is over 80, it’s considered overbought and an exit point to sell. But if the reading is under 20, it’s considered oversold and provides an entry point to buy. Both cases are shown in the example chart below.

Advanced Scalping strategies

The strategies discussed so far have been considered simple techniques used by scalpers. Experienced scalpers may use more advanced techniques as listed below.

Risk management

Because scalpers rely on small price changes on hundreds of trades, there needs to be a level of risk management to prevent even the smallest loss. As a result, experienced scalpers will set a stop loss and take a profit position on every trade.

Algorithms

Algorithmic trading essentially allows an automated program or robot to do the trading for you. Commonly known as expert advisors, even major hedge funds and banks use algorithmic programs over humans.

Profit-risk ratio

Also considered part of risk management, experienced scalpers will implement a 1% rule. That means not trading, or risking, more than 1% of their account balance on an open position.

Is Scalping the right strategy for me?

Scalping is one of many strategies used by Forex traders. Due to its use of technical indicators and analysis, not every investor relies on this style of trading. In fact, some traders will only rely on fundamental factors before opening a trade. Most will use a combination of fundamental and technical indicators, it’s completely up to the individual. No matter what style of trading you prefer, it’s important to remember profits are not guaranteed and your losses may outweigh your investments.