Fundamental vs Technical Analysis

There are many external factors to consider before trading a financial asset. This can include identifying price trends or even identifying demand and supply levels for a particular asset.

However, traders will look into both sources to gain an overall idea of the market.

What is fundamental analysis?

Traders will look into fundamental analysis when trying to work out the value of a financial asset. To do this, they will examine both economic and financial factors that can affect the value of the asset. Factors can also include macroeconomic issues such as the overall economy as well as microeconomic factors which can outline a company’s management and its effectiveness.

Fundamental analysis uses an economic approach in determining currency movements. Economic, social and political forces also come into play. Central bank movements, interest rate cycles, inflation, manufacturing and services, employment figures and other various economic barometers are used in this analysis.

Sensitive or tumultuous meetings between national leaders can also influence foreign exchange values if there are unresolved economic issues. Trade talks between the United States and China can be used as an example here. Sometimes, even passing comments by country leaders can result in a buy-up or sell-off.

When looking at the value of a stock, for example, the trader will look into the company’s revenue and potential future growth. This will be publicly listed in a company’s financial statements.

It is also important to note that fundamental analysis will cover both quantitative and qualitative findings to examine the value of financial assets. Quantitative findings have solid numbers that mostly are sourced from financial assets. Qualitative findings are looking into the company structure, management structure, brand recognition among others.

When looking into a company, traders will consider the following qualitative fundamentals:

The company’s business model

The trader will look into what the business does. Is it a business model that is making revenue or if it is just staying afloat?

The company’s competitive advantage

How does the company stand out from its competitors? The trader will look at the advantage that the company has and if it is a monopoly in the relative industry.

The company’s management structure

Examining the management within a company is also a core aspect of qualitative fundamental analysis. This means looking at the board of a company in detail to see if it has effective senior managers in place. They can drive the growth of a business.

Corporate governance policies

These are the policies that are put in place to describe the responsibilities of the key management and stakeholders of the company. This can highlight how transparent the company is as well as how ethically it is managed.

What is technical analysis?

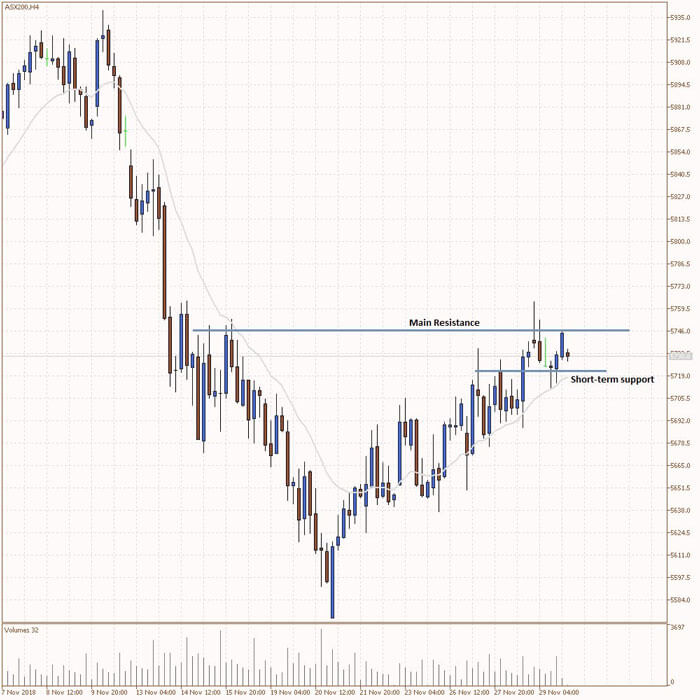

Unlike fundamental analysis, technical analysis reviews past trends and patterns to identify future trading opportunities in the market. The trader will use the asset’s charts to highlight price points in the short term and long term. Technical traders will use the following tools such as lines of resistance and support, price analysis, moving averages, ‘head and shoulder’ patterns as well as the relative strength index.

Technical analysis will solely look at the price charts of the financial asset rather than looking at external factors such as company management structures. The trader will look at price patterns and try and predict future movements.

The below chart of the ASX200 is an example of resistance and support lines. They have been identified over a 3-week period.