The NASDAQ-100 Trading Approaches: Scalping, Intraday, and Swing Trading

Trading the NASDAQ-100, a stock market index that includes the top 100 non-financial companies listed on the NASDAQ exchange, offers a plethora of opportunities for traders. However, the approach taken can significantly impact the potential for profit and the level of risk involved. This article will explore three common trading strategies: scalping, intraday trading, and swing trading, providing an in-depth comparison of their characteristics, advantages, and drawbacks.

1. Scalping the NASDAQ-100

Scalping is a high-frequency trading strategy where traders aim to profit from small price movements over short periods. Here’s a detailed look at when scalping the NASDAQ-100 is preferred and why:

High Market Volatility:

- Volatility

- Scalping is best suited for periods of high market volatility. During these times, price movements are more frequent, offering numerous opportunities for quick, small gains. Indices are usually most volatile at the start of the correlated Stock Market Session and at the end of it.

- Liquidity:

- Scalpers rely on liquidity to swiftly enter and exit positions. The NASDAQ-100, being one of the most heavily traded indices globally, provides ample liquidity, making it an attractive option for scalpers.

Short Time Horizons:

- Scalping thrives on extremely short timeframes, often ranging from seconds to minutes. Traders aim to capitalize on the smallest price movements, so they’re in and out of positions swiftly.

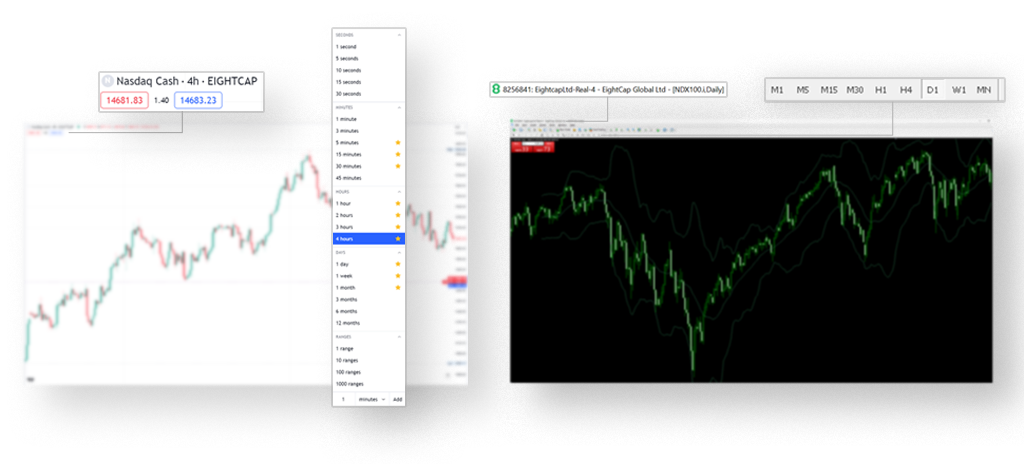

- Our Metatrader 4 and Metatrader 5 Platforms offer fast time frame charts from 1Minute and above. For hyper scalping approach, traders turn to their Eightcap Accounts on Trading View as this platform offers charts showing price movements from 1second,5 seconds,10 seconds,15 seconds and 30 seconds graphs.

Fast Execution and Technology:

- Scalpers require a reliable trading platform with high-speed execution capabilities. Cutting-edge technology and low-latency connections are essential for timely order placement and execution.

- A number of our Clients also use the Forex VPS services we offer to avoid disconnections and secure and reliable platform functionality.

Tight Spreads:

- The bid-ask spread is crucial for scalpers. A tight spread (the difference between the buying and selling price) ensures that traders can enter and exit positions with minimal slippage, which is critical for profitability. You can confirm our NASADQ100 trading details here.

Precision and Discipline:

- Scalpers rely heavily on technical analysis and often implement strict stop-loss and take-profit levels. Discipline in adhering to these levels is paramount for successful scalping.

Risk Management:

- Due to the high frequency of trades, risk management is crucial. Scalpers use tight stop-loss orders to limit potential losses. They often maintain a balanced risk-reward ratio to ensure that losses are controlled.

Avoidance of Overnight Risk:

- Scalpers aim to close all positions before the end of the trading day. This minimizes exposure to overnight market movements, which can be unpredictable and potentially lead to losses.

Emotional Control:

- Scalping can be demanding from a psychological standpoint. The fast-paced nature of this strategy requires traders to make quick decisions and maintain emotional discipline to avoid impulsive actions.

Advantages:

- High Frequency: Scalpers execute a large number of trades in a single day, often holding positions for only a few seconds or minutes. This can lead to multiple small gains, which can add up over time.

- Reduced Exposure to Overnight Risk: Scalping typically involves closing all positions before the end of the trading day, mitigating the risk associated with overnight market movements.

- Precision and Discipline: Scalpers rely on technical analysis and often implement strict stop-loss and take-profit levels, enforcing discipline in their trading approach.

Drawbacks:

- High Transaction Costs: Due to the large number of trades executed, scalpers may face higher commissions and spreads, which can eat into profits.

- Psychological Stress: The fast-paced nature of scalping can be mentally demanding, requiring quick decision-making and the ability to manage emotions effectively.

- Limited Profit Potential: Although scalping can yield frequent small gains, the overall profit potential per trade is relatively small compared to other strategies.

Scalping the NASDAQ-100 is most effective when market conditions are highly volatile, liquidity is ample, and spreads are tight. Traders who choose this strategy need to be well-prepared with the right technology, a disciplined approach, and a keen understanding of risk management. It’s important to note that scalping is a high-stress, high-reward strategy, and it’s not suitable for all traders. Those who thrive in fast-paced environments and can handle the associated demands may find success with scalping in the NASDAQ-100.

2. Intraday Trading the NASDAQ-100

Intraday trading, also known as day trading, involves opening and closing positions within the same trading day. It’s a popular strategy for traders looking to capitalize on short to medium-term price movements. Here’s an in-depth look at when and why Intraday Trading the NASDAQ-100 is preferred:

Volatility and Momentum:

Intraday traders thrive on volatility. They seek assets, like the NASDAQ-100, that exhibit significant price movements within a single trading session. This provides opportunities to profit from both upward and downward momentum.

Liquidity and Order Execution:

The NASDAQ-100 is known for its high liquidity, making it an attractive choice for day traders. This means traders can quickly enter and exit positions without significantly impacting prices.

Risk Management and Stop-Losses:

Intraday traders implement strict risk management strategies. They use stop-loss orders to limit potential losses on a trade, helping to protect their capital.

Both Long and Short Opportunities:

Intraday traders can profit from both rising and falling markets. They can take long positions when they expect prices to rise and short positions when they anticipate a decline.

Access to Leverage:

Intraday traders utilize margin accounts, which allow them to amplify their positions. This can increase potential profits, but it also magnifies potential losses, so it requires careful management. Leverage, they say, is a two-edged knife.

Technical Analysis and Chart Patterns:

Intraday traders heavily rely on technical analysis, using indicators, chart patterns, and price action to identify potential entry and exit points. This helps them make informed decisions within the short timeframes of a single trading session.

Psychological Preparedness:

Intraday trading can be mentally demanding. The rapid pace of decision-making requires traders to stay focused, manage their emotions, and adhere to their trading plan.

Potential for Whipsaws:

In summary, Intraday Trading the NASDAQ-100 is preferred in environments characterized by high volatility, ample liquidity, and significant price movements within a single trading day. Traders who choose this strategy need to commit substantial time, implement strict risk management, and have a deep understanding of technical analysis. It’s a strategy that requires discipline, emotional control, and the ability to adapt quickly to changing market conditions.

Advantages:

- Limited Exposure to Overnight Risk: Like scalping, intraday traders typically close all positions before the end of the trading day, reducing exposure to overnight market movements.

- Opportunities for Both Bull and Bear Markets: Intraday traders can profit from both rising and falling markets by taking long and short positions, respectively.

- Access to Leverage: Intraday traders often have access to margin accounts, allowing them to amplify their positions and potentially increase profits.

Drawbacks:

- Time-Intensive: Intraday trading requires a significant time commitment, as traders need to closely monitor the market throughout the trading day.

- Emotional Discipline: Like scalping, intraday trading can be emotionally demanding, requiring traders to manage their emotions and adhere to their trading plan.

- Potential for Whipsaws: Intraday traders are susceptible to market whipsaws, where prices rapidly change direction, potentially leading to losses.

Swing Trading the NASDAQ-100

Swing trading is a strategy that involves holding positions for several days or weeks to capture medium-term price movements. It’s a popular choice for traders seeking to take advantage of more significant price swings. Here’s an in-depth look at when and why Swing Trading the NASDAQ-100 is preferred:

Market Conditions:

- Swing traders look for assets, like the NASDAQ-100, that exhibit a tendency to trend over several days or weeks. They seek markets with a clear directional bias, either bullish or bearish. Usually, such conditions are evident shortly after the earnings seasons, whereas traders are mostly looking at the top 100 High Tech stocks included in this index.

Reduced Time Commitment:

- Unlike scalping or intraday trading, swing trading requires less time commitment. Traders do not need to monitor the market as closely, making it suitable for those with other commitments.

Risk Management and Position Sizing:

- Swing traders implement risk management strategies to protect their capital. They often use wider stop-loss levels compared to scalpers or day traders. Position sizes are adjusted to align with the chosen level of risk, which has always been a challenge and a must to any type of approach on any known instrument. Our Traders take full advantage of our free of charge trading calculators in that regard, especially the Margin Calculator situated in the Client Portal area.

Longer Time Horizons:

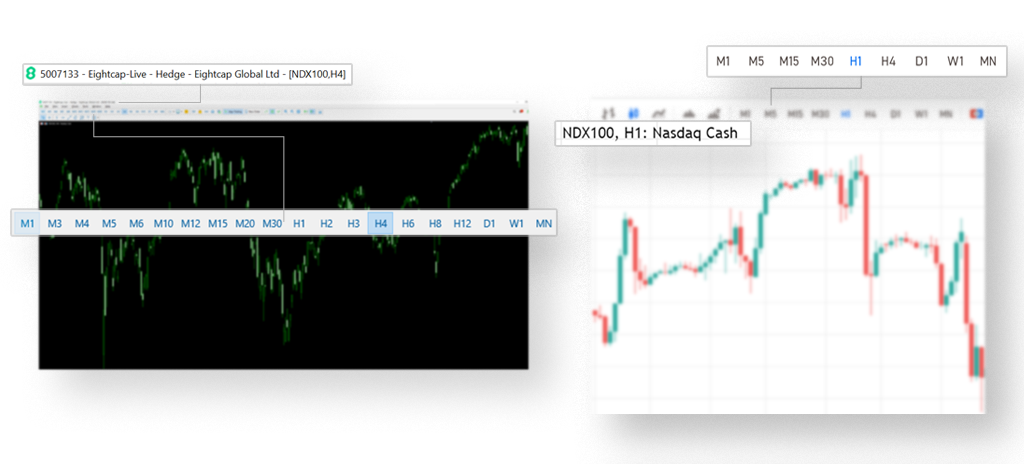

- Swing traders hold positions for several days or weeks, allowing them to ride out short-term price fluctuations. This also means they are exposed to potential overnight risk and market gaps. The analysis are usually done on time frame charts ranging from all available hourly Charts (1H,2H,3H,4H,6H,12H) to Daily and weekly and even Monthly Charts.

By the way, we offer 4 types of Trading Platforms to our Traders: MetaTrader4, MetaTrader5, WebTrader and Trading View. Among the features that differentiate those platforms from one another are the time frame chart types they offer. Below you will find snapshots showing those differences to you:

Avoidance of Overtrading:

- Swing traders execute fewer trades compared to scalpers or day traders. This reduces the impact of transaction costs and allows traders to focus on high-quality setups. Overtrading, a problem active traders are facing every now and then, is easier to be avoided.

Potential for Larger Profits:

- Swing traders aim to capture more substantial price movements compared to scalping or intraday trading. While the frequency of trades may be lower, the potential profits per trade are typically higher.

Psychological Preparedness:

- Swing trading requires a different psychological approach compared to shorter-term strategies. Traders need to have the patience to wait for trades to develop and the discipline to stick to their trading plan.

Risk of Overnight Gaps:

- Since swing traders hold positions overnight and over weekends, they are exposed to potential market gaps due to news events or economic releases. This can lead to unexpected price movements.

Advantages:

- Reduced Time Commitment: Swing traders do not need to monitor the market as closely as scalpers or intraday traders, making it a more suitable option for those with other commitments.

- Less Emotional Stress: Swing trading allows for more time to make decisions, reducing the emotional intensity compared to scalping and intraday trading.

- Potential for Larger Profits: Swing traders aim to capture larger price movements, potentially leading to more substantial profits compared to scalping or intraday trading.

Drawbacks:

- Exposure to Overnight Risk: Unlike scalping and intraday trading, swing traders hold positions overnight and over weekends, exposing them to potential market gaps and news events.

- Lower Frequency of Trades: Swing trading involves fewer trades compared to scalping and intraday trading, which means that profits may be less frequent.

Swing Trading the NASDAQ-100 is preferred in environments characterized by trending markets with clear directional biases. Traders who choose this strategy benefit from reduced time commitments, the potential for larger profits, and a focus on technical analysis. It requires patience, discipline, and the ability to manage positions over longer time horizons. Additionally, swing traders need to be aware of potential overnight risks and market gaps.

When should traders exercise caution in trading the NASDAQ100 index?

Firstly, events such as major economic announcements, geopolitical tensions, or unexpected political developments can introduce significant volatility and unpredictability to the NASDAQ-100. During these periods, it is crucial for traders to be aware of potential rapid price swings and increased market sensitivity. Moreover, it is advisable to closely monitor news sources and stay updated on any potential catalysts that may influence the index. By approaching trading with heightened vigilance during these times, traders can better navigate the potentially turbulent waters of the NASDAQ-100.

Our Clients are taking advantage of our state-of-the-art Economic Calendar for such analysis and research.

Secondly, Traders should exercise an abundance of caution during significant events like earnings reports of major tech companies within the NASDAQ-100. These reports often lead to sharp and unpredictable price movements, as they directly influence the valuation and sentiment of the entire index. Surprises in revenue, earnings, or forward guidance can trigger rapid market reactions. It is essential for traders to be aware of the earnings calendar and major events related to tech giants, allowing them to plan their trades accordingly.

Volatility Dynamics on the NASDAQ-100

The NASDAQ-100 is renowned for its dynamic and often spirited market behavior. When examining the hourly volatility, it’s notable that the opening hour of trading, from 9:30 AM to 10:30 AM (ET), tends to exhibit heightened activity. This period frequently sees rapid price movements as market participants react to overnight news and developments. Similarly, during the final hour of trading, from 3:30 PM to 4:00 PM (ET), volatility tends to pick up again as traders position themselves for the close. On a daily scale, Mondays and Fridays often register more pronounced swings due to factors like weekend news flow and position adjustments before the close. Furthermore, the weekly perspective underscores that the NASDAQ-100 can be particularly dynamic during periods of high market events, such as earnings seasons or major economic releases. Traders should be mindful of these patterns and adjust their strategies accordingly, acknowledging that heightened volatility can present both opportunities and risks.

The typical price range in a day for the NASDAQ-100 can vary widely based on market conditions, economic events, and other factors. However, historically, the average daily range for the NASDAQ-100 has often been between 1.5% to 2.5% of its total value. This means that on an average trading day, the index may move up or down within a range of approximately 1.5% to 2.5% from its opening price to its closing price.

Keep in mind that this is a general estimate and actual daily ranges can fluctuate significantly. During periods of heightened volatility, such as major news releases or significant market events, the daily range can be much larger. Traders should always be aware of current market conditions and adjust their strategies accordingly to account for potential price fluctuations.

Choosing the right approach to trading the NASDAQ-100 depends on individual preferences, risk tolerance, and time availability. Scalping offers quick, frequent trades but requires intense focus. Intraday trading provides opportunities for both rising and falling markets, demanding a substantial time commitment. Swing trading offers a more relaxed pace with the potential for larger profits, but involves holding positions overnight. Each approach has its own set of advantages and drawbacks, and traders should carefully consider their goals and resources before selecting a strategy.

* The information provided here has been prepared by Eightcap’s team of analysts. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap.

In addition to the disclaimer on our website, the material on this page does not contain a record of our trading prices, or represent an offer or solicitation for a transaction in any financial instrument. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Please note that past performance is not a guarantee or prediction of future performance. This communication must not be reproduced or further distributed without prior permission.