Breakout strategy for FX trading

A breakout occurs when the price of a currency pair moves outside of a defined range or level of support or resistance. By using a breakout strategy, traders can attempt to capitalize on these moves and potentially generate profits.

Here are the key steps involved in implementing a breakout strategy for FX trading:

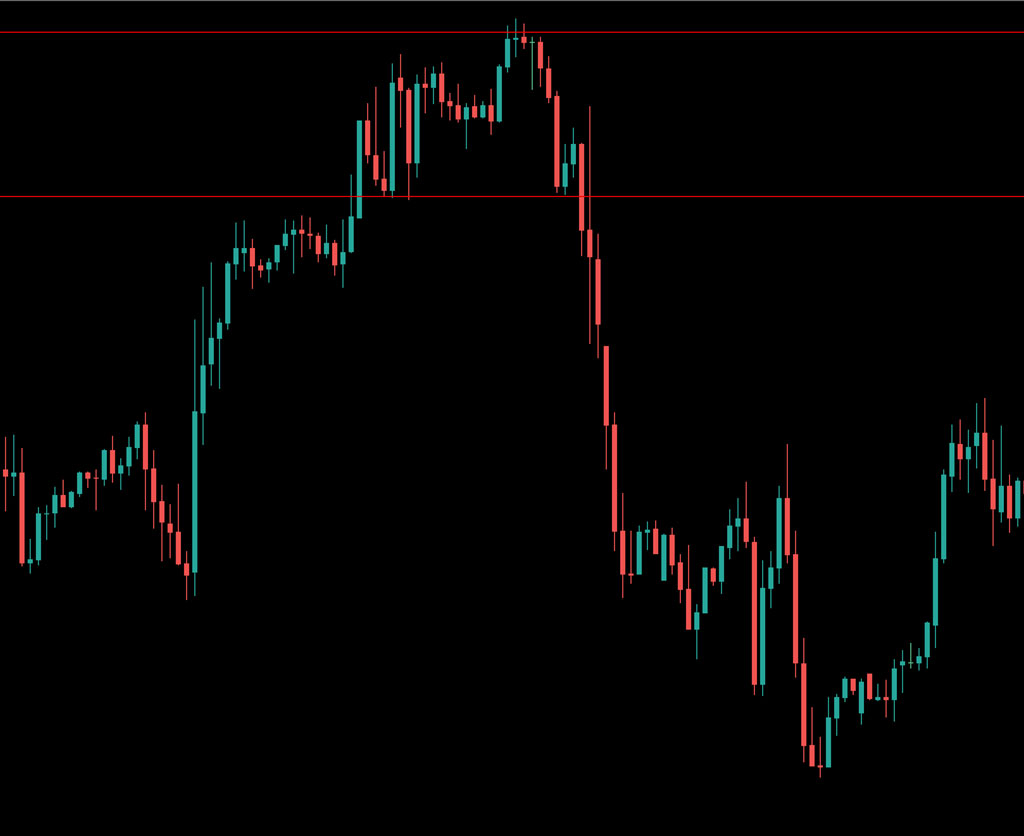

Step 1: Identify Key Levels of Support and Resistance

The first step in implementing a breakout strategy is to identify key levels of support and resistance on the price chart of the currency pair you want to trade. Support and resistance levels are areas on the chart where the price has previously struggled to move beyond, either because of buying or selling pressure.

Step 2: Monitor Price Action Near These Levels

Once you have identified the key levels of support and resistance, the next step is to monitor the price action near these levels. Look for instances where the price approaches these levels and either bounces off them or breaks through them. This can be an indication that a breakout is about to occur.

Step 3: Wait for a Confirmed Breakout

When the price approaches a key level of support or resistance, wait for a confirmed breakout before entering a trade. A confirmed breakout is when the price moves outside of the defined range and stays above or below the level for a sustained period of time.

Step 4: Enter the Trade and Set Stop Losses

Once you have identified a confirmed breakout, enter the trade and set stop losses to manage your risk. Stop losses can be placed below the support level for a long trade or above the resistance level for a short trade. This will help limit your potential losses if the trade does not go as expected.

Step 5: Monitor the Trade and Take Profits

After entering the trade, monitor it closely and consider taking profits at key levels of support or resistance. This will help lock in profits and reduce your exposure to market volatility.

Here are some of the most commonly used tools available in MetaTrader and how to apply them to your breakout strategy:

- Horizontal Lines: Horizontal lines can be used to mark key levels of support and resistance on your price chart. To apply them in MetaTrader, select the “Horizontal Line” tool from the toolbar and click and drag it to the appropriate level on your chart.

- Fibonacci Retracement Tool: Fibonacci retracements are a technical analysis tool used to identify potential levels of support and resistance. To apply this tool in MetaTrader, select the “Fibonacci Retracement” tool from the toolbar and click and drag it from the low to the high of the price move that you are analyzing.

- Moving Averages: Moving averages can be used to identify the overall trend of the market and to confirm breakouts. To apply moving averages in MetaTrader, select the “Indicators” tab, choose “Moving Average” from the list of indicators, and adjust the settings to suit your trading strategy.

- Price Alerts: Price alerts can be set up in MetaTrader to notify you when the price of a currency pair reaches a specific level. To set up a price alert, right-click on your price chart and select “Create Alert.” Choose the type of alert you want to create and set the appropriate parameters.

- Stop Loss and Take Profit Orders: Stop loss and take profit orders are essential for managing your risk and locking in profits. In MetaTrader, you can set up these orders by right-clicking on your open position and selecting “Modify or Delete Order.”

By identifying key levels of support and resistance and waiting for a confirmed breakout, traders can potentially generate profits while managing their risk.

The information provided here has been prepared by Eightcap’s team of analysts. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap.In addition to the disclaimer on our website, the material on this page does not contain a record of our trading prices, or represent an offer or solicitation for a transaction in any financial instrument. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Please note that past performance is not a guarantee or prediction of future performance. This communication must not be reproduced or further distributed without prior permission.