Crypto Focus: Another Friday Waiting Game Set Around the USD.

Another week, and another Friday waiting game set around the USD. This time last week, we found ourselves in a similar situation, waiting for key news that could set the fortunes of the USD over the short term and, conversely, impact Cryptocurrencies. Last Friday, Powell confirmed the Hawkish stance set by the Fed. This sent Crypto lower for a 2nd straight week, cutting down earlier gains seen in the week.

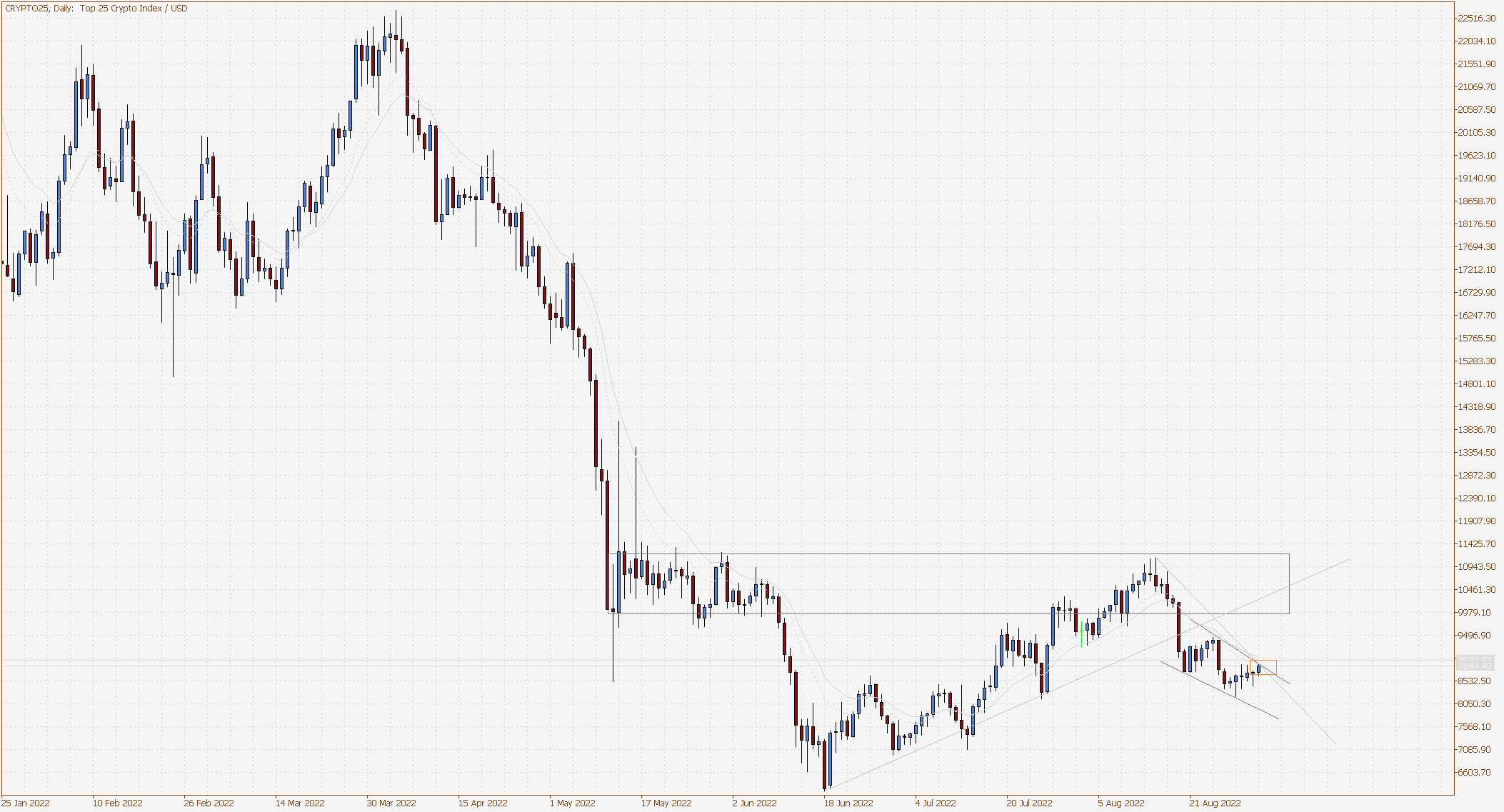

The Top 25 gave back a 7% lead to finish 3.18% lower.

This week traders are looking to today’s NFP data. There has been a fair bit of expectation around this week’s data as if hotter figures came in. It could reinforce hawks at the Fed and maintain the expectations of higher rate rises and a firmer USD. A stronger USD has been a factor lately that has been hurting Crypto. Well, today’s Employment data has given us a small surprise. Average earnings fell to 0.3%, unemployment increased to 3.7%, and the payrolls came in at 315k above the 295k expected but well below the last figure.

Crypto liked the data as it shows things are not as hot as expected, which could influence the Fed. That’s an if as we will need to hear their comments. Rising unemployment is a surprise, and that alone could be an issue for the Fed’s plan to hike rates aggressively, but again we will need to see their response.

After the release, Crypto rallied as the USD fell from today’s highs. ETH was hitting 4% in gains before sellers trimmed some gains. Looking at the top 25 daily chart, we want to see buyers break the current bear channel, which starts to show a change in momentum.

From there, we want to see a new downtrend beaten and a new move from buyers back up the supply area that stopped the last rally.

* The information provided on this page are the opinions of the author and do not necessarily reflect the opinions of Eightcap and are not endorsed by Eightcap.

Any person acting on the information presented on this page does so entirely at their own risk. No representation or warranty is given as to the accuracy or completeness of this information. Any research provided does not have regard to any specific investment objectives, financial situation and needs of any specific person who may receive it.

Margin trading involves a high level of risk and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Eightcap, and seek independent advice if necessary.