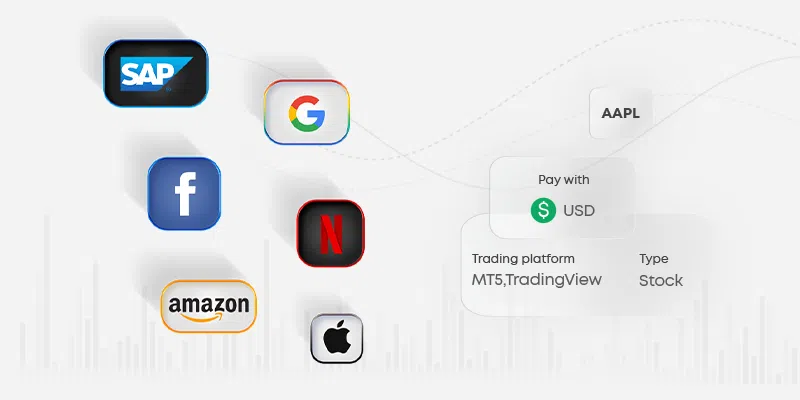

Trade Share CFDswith us

Trade the most popular shares from around the world.

Compare our costs against other brokers

Keep your trading costs down with our tight spreads that are up to five times lower than other top brokers.

See why traders trade shares with us

Powerful trading tools

Take full advantage of multi-award-winning platforms and the latest innovations in trading tools.

Chart. Chat. Trade.

Join a community of over 50 million traders. Trade directly from TradingView charts into an account with us, with access to an advanced charting package, frequent trading strategy ideas, webinars, custom indicators, and more — all from the world’s largest social trading network.

Learn more

MetaTrader 5

Trade shares, FX, cryptos, indices & commodities on mobile & desktop, web trading, instruments in 21 time-frames and 80 pre-installed indicators.

Read more

Code-free automation

Create, test and automate trading strategies using everyday English with Capitalise.ai.

Trade faster with FlashTrader

Target multiple profits, calculate position size, and place stops and limits in a flash – all with just one little click, using your trade ticket.

Stay ahead of the curve

Grow in a community of traders – with guidance from professionals.

Get inspired with Trade Zone

Get weekly trade ideas from our experts, with weekly market forecasts and mid-week commentary webinars.

Get inspired

Eightcap Labs

Bridge the gap between theory and practice and learn how to trade more effectively.

Webinars with experts

Learn the fundamentals of trading with regular guest analyst live events, in a community of like-minded traders.

Join us now

Apply for a live account in a few minutes or try a free demo account.

Which account is best for you?

Compare our TradingView, Standard or Raw accounts, or get in touch with us and have a dedicated account manager help you.

Compare account

Create an account

Sign up, create an account and start trading on low spreads with us today, with access to over 800 financial instruments.

Not sure?

Take our demo account for a spin in a reduced risk environment to familiarise yourself with us.